You have a stable, high-paying job at a major company in Seoul. You pay your ₩1.5 million rent on time. You never miss your phone bill. You probably have an 800+ credit score back home that you’ve spent years building.

So why did the bank teller just laugh you out of the building for applying for a simple, basic credit card? Why did the Coupang app reject your ‘Rocket Wow’ monthly payment plan? Why can’t you finance a simple car?

Welcome to the “Expat’s Financial Nightmare: The ‘Thin Filer’ (씬파일러)”.

To the entire Korean financial system, you are a ghost. You don’t exist. Your perfect financial history from the US, UK, Canada, Germany, or anywhere else? It means *nothing* here. As an MBA who has navigated this exact financial “nightmare”—both personally and for business—I’m going to show you how to build your Korean Credit Score for Foreigners from absolute zero.

This isn’t just about getting a shiny piece of plastic. This is about your entire financial life in Korea. It’s about getting a real loan (전세, Jeonse) or mortgage, financing a car, proving you’re reliable, and ultimately stop being treated like a financial ‘ghost’. Let’s fix your “invisible” problem. This is the definitive guide on how to build a Korean credit score for foreigners.

Why Are You a Ghost? The “Thin Filer” (씬파일러) Problem

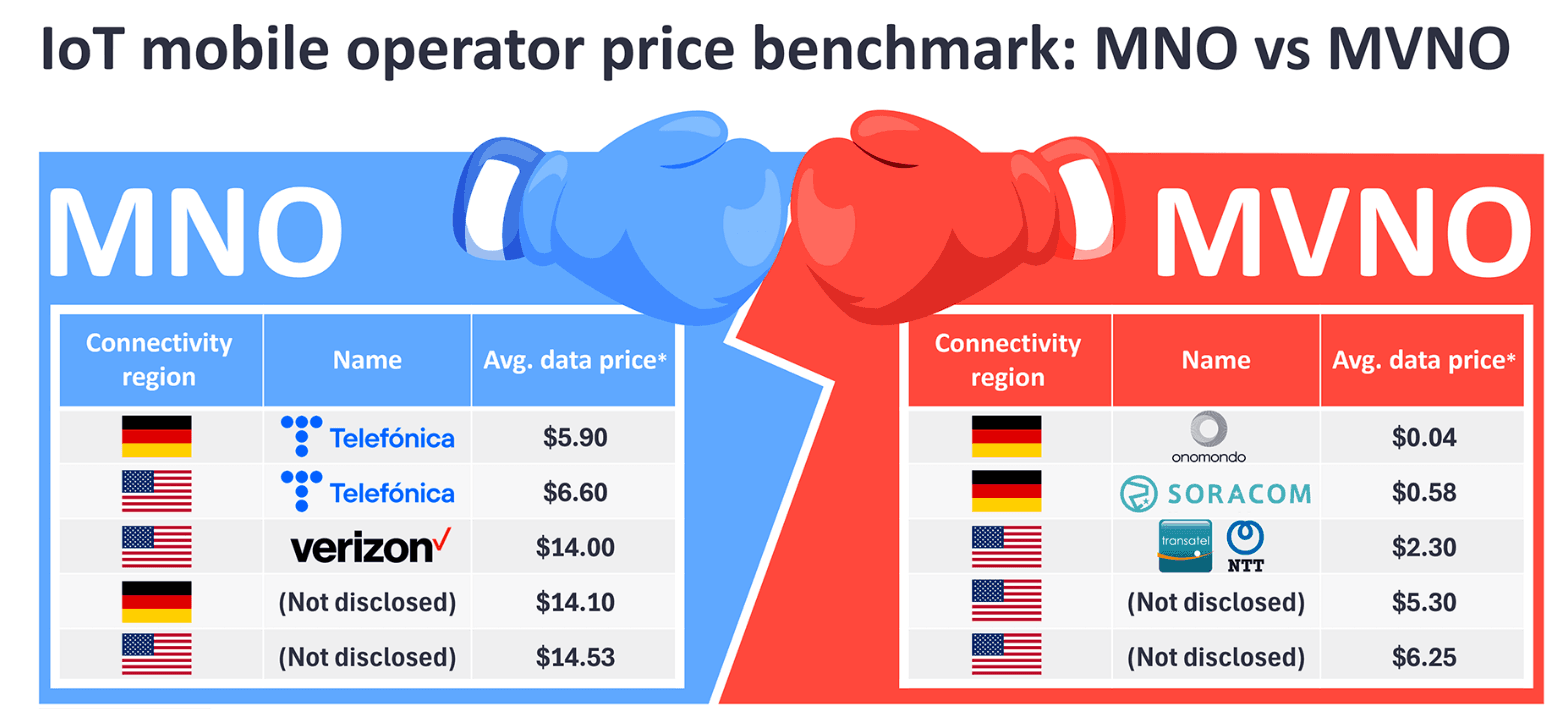

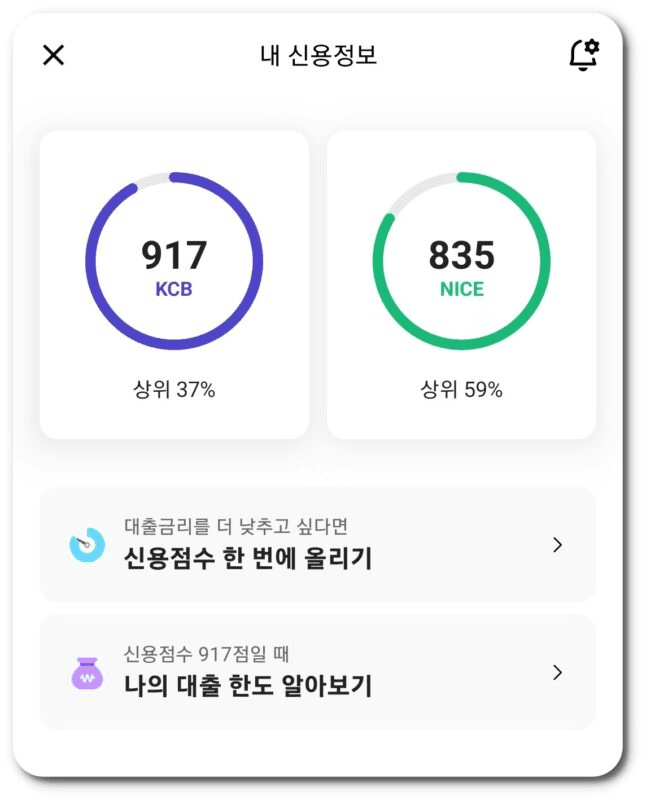

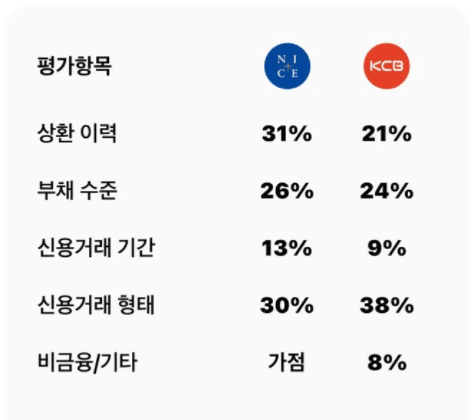

Korea, like most countries, runs on centralized credit bureaus. Your entire financial reputation is decided by two companies. The two main players you MUST know are:

- NICE (나이스): National Information & Credit Evaluation. (Often used by banks for loan assessments).

- KCB (올크레딧): Korea Credit Bureau. (Often used by credit card companies).

When you first arrive and get your Alien Registration Card (ARC), your file at these bureaus is “thin” (씬파일러) or completely non-existent. The banks have zero data on you. In their automated risk-assessment systems, a person with “no data” is not a “neutral” risk; they are a **100% High Risk**.

The Expat’s Catch-22: You need a credit history to get a credit card, but you need a credit card to build a credit history. This is the core ‘nightmare’ for building a Korean credit score for foreigners.

This is the paradox that traps 99% of foreigners. They assume their high salary and official E-7/F-5 employment contract are enough. They are not. Banks are lazy; their systems don’t want to “read” your contract. They want to see a “score” from NICE or KCB. If that score is “0” or “Grade 6+” (on the old 1-10 scale), you are automatically rejected by their system. No human intervention. “Computer says no.” ㅋㅋㅋㅋㅋ

So, how do you break this “Catch-22”? You have to manually *create* data. You have to ‘manufacture’ your own trust.

Step 1: The “Traditional” Path (Your Main Bank)

Before we get to the “cheat code,” you must try the simple, logical path first. This establishes your first “rejection” which is sometimes necessary.

Do not apply randomly online. Do not walk into the first bank you see on the street. You must go to the **main branch** (or your local branch) of the **bank where your salary (급여이체) is deposited** every single month. This is your “main bank” (주거래 은행), and they are the *only* ones who have any human incentive to help you.

- Who to Ask For: Ask for the branch manager (지점장) or the head of the “foreign customer” desk (if they have one). Hana Bank (formerly KEB) has a long and reputable history of being foreigner-friendly.

- What to Ask For: Ask for the most basic, lowest-limit credit card they offer. Do *not* ask for the “premium travel points” or “VIP lounge” card. You are building, not optimizing. Your goal is to get *any* revolving credit line.

- What to Bring (Your Full Arsenal):

- Alien Registration Card (ARC) (Front and Back Copy)

- Passport

- Employment Contract (재직증명서) – Must be recent.

- Proof of Salary Deposits for 6+ Months (급여이체 내역서) – Ask the clerk to print this for you.

- (Optional but HIGHLY Recommended) Certificate of Income (소득금액증명원) from Hometax. This is your ‘official’ government-verified income.

If you get approved for even a ₩500,000 limit card—congratulations! You are in the game. You can skip to Step 3.

…But most of you, even with all this, will still get **rejected**. The bank clerk will shrug and say “시스템(system) says no.”

When this happens, it’s time for the “Cheat Code.” This is how you force the system to see you.

Step 2: The “Cheat Code” (Building Your Score *Without* a Bank)

This is the most important part of this entire guide. This is the 100% legal, 100% effective ‘hack’ that 99% of expats do not know about. This is the secret to building a Korean credit score for foreigners.

If the banks (금융) won’t give you credit, you will prove your creditworthiness using your **”non-banking” (비금융)** bills. You will manually submit proof that you are a reliable, bill-paying person directly to the credit bureaus (NICE & KCB).

Your Secret Weapons: Your Monthly Bills

You need to gather 6-12 months of *perfect, on-time payment records* for the following. These records prove you are not a ‘ghost’.

- National Health Insurance (국민건강보험): This is the **most powerful** one. If you are an E-7, F-series visa holder, or even a D-2 student (on regional insurance), you are paying this. This is your #1 tool.

- National Pension (국민연금): Also very powerful. Shows stable employment.

- Phone Bill (통신요금): This MUST be a ‘post-paid’ plan (후불) with SKT, KT, or LG U+. A pre-paid (선불) SIM card does *nothing* for your credit. It has to be a contract in your name, linked to your ARC.

- (Optional) Utility Bills (공과금): Gas, electricity, water. These are slightly less powerful but still help.

How to Submit (The “Cheat Code” Step-by-Step)

You don’t mail these in. You submit them online. Yes, the websites are 99% in Korean, which is why it’s a “nightmare” (and why you need this guide ㅋㅋㅋ). You will need your digital certificate (공인인증서) or another form of Korean ID (본인인증) to log in.

- For NICE (나이스):

- Go to the `NICE Z-Keeper (niceinfo.co.kr)` website.

- Find the menu for **”비금융정보 등록”** (Register Non-Banking Information).

- You will need to use your bank certificate or phone to log in.

- Follow the steps to automatically pull your payment data from the NHIS (Health Insurance) and Phone Company. It’s often an automated scrape.

- For KCB (올크레딧):

- Go to the `Ollcredit (allcredit.co.kr)` website.

- Find the menu for **”신용점수 올리기”** (Raise Credit Score) or “비금융정보 등록”.

- Log in and follow the same process.

Within a few days, your score will **JUMP**. You will no longer be a “ghost.” You will be a “real” person (often starting at Grade 4 or 5) in their system. Now, when you walk back into that bank (Step 1), the clerk’s computer will show a **REAL SCORE**, and your chances of approval just went up 1000%.

Step 3: You Got a Card. Now What? (The Rules)

Getting the card is just the start. Now you have to build your score from “Rookie” to “All-Star.” This is where many foreigners (and Koreans!) fail. Do *not* shoot yourself in the foot. ㅋㅋㅋㅋㅋ

MBA Pro-Tip: The Korean credit system punishes “risk” (like high debt, late payments) more than it rewards “spending.” Your goal is not to be a “big spender.” Your goal is to be a **”boring, 100% reliable payer.”**

- PAY 100% EVERY MONTH. I cannot say this enough. Do NOT use the “revolving(리볼빙)” service. That is a debt trap and the #1 killer of credit scores in Korea. Always pay the *full balance* (전액결제) on time, every time. Set up auto-debit (자동이체).

- Keep Utilization LOW. This is the second biggest secret. Do not max out your card. If your limit is ₩1,000,000, do *not* spend ₩990,000. Try to use only **30-50%** of your total limit (e.g., ₩300,000 – ₩500,000) each month. A high utilization ratio signals “risk” and drops your score.

- Do NOT Apply for 5 Cards at Once. Every time you apply for a card or loan, it leaves an “inquiry” (조회). Too many inquiries in a short time make you look “desperate” for money and will destroy your score. Wait at least 6 months between applications.

- Use Check Cards (체크카드). This is a classic Korean strategy. Using your “check card” (debit card) linked to your main bank account consistently (e.g., ₩300,000+ per month) also slowly builds your credit score with that bank.

- Be Patient. After 6-12 months of this “boring” behavior (paying 100%, low utilization, consistent check card use), your score will rise significantly.

Conclusion: From “Ghost” to “VIP”

Building a Korean credit score for foreigners is a “process,” not a “nightmare,” as long as you know the rules of the game. The “system” isn’t designed to exclude you; it’s just designed to run on data. Your job is to *give* it the right data.

Stop being an “invisible” ghost. Use the “Cheat Code” (Step 2: Non-Banking Info Submission), get your first card (Step 1), use it responsibly (Step 3), and in one year, you will be the one getting “VIP” offers from the bank. Good luck.

Disclaimer: This article is for informational and educational purposes only, based on my personal and professional experience as an MBA in Korea. It is not financial advice. The rules and processes of credit bureaus (NICE/KCB) and banks can change. Please consult a professional financial advisor for your specific situation. For official information, always check with the FSS (Financial Supervisory Service).

JS Network: Solving Korea’s ‘Expat Nightmares’

Colin (Founder) | U.S. MBA | 11+ Yrs Global Experience

My Expertise:

• Expat ‘Nightmare’ Solutions (Visa, Housing, Banking)

• Global Trade & K-Product Sourcing (B2B/B2C)

• Premium Concierge & Travel Support

Contact Now:

📧 [email protected]

📱 Chat on WhatsApp | Chat on KakaoTalk

We respond quickly to all inquiries, but for 24/7 “URGENT” assistance (like a lost ARC or visa issue), please use Kakao/WhatsApp.

(All services are provided in conjunction with appropriate affiliated professionals (lawyers, administrative agents, judicial scriveners, etc.))

© JS Network Co., Ltd. | Expat ‘Nightmare’ Solutions 🌏 www.jsnetwork.co.kr