This korean bank account frozen case study is based on a real situation faced by a foreign professional living in Korea, whose main bank account was suddenly locked without warning. One morning, card payments started failing, online banking showed error messages, and a simple transfer was rejected with a generic system notice. There was no clear explanation, no phone call, and no email from the bank. For the client, this was not only a financial inconvenience, but a serious threat to rent, bills, and even visa stability.

The goal of this case study is to show, in practical and concrete detail, what actually happens when a bank account is frozen in Korea, how a foreigner typically experiences the process, and how a structured response can lead to a successful release. Rather than theory, this article follows the timeline of a real case: confusion, panic, contact with the bank, documentation requests, and the final resolution.

The Moment Everything Stopped: How the Problem First Appeared

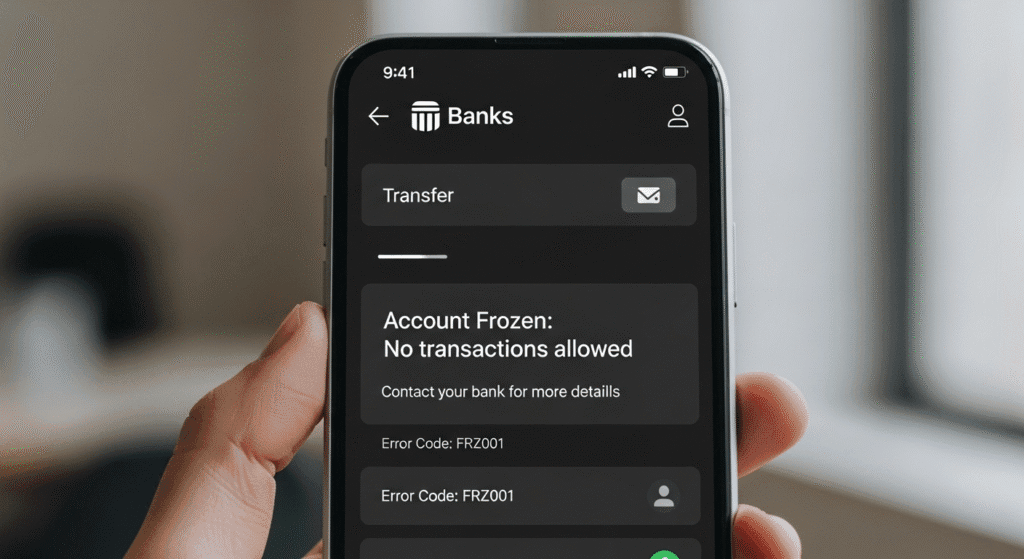

The client first noticed something was wrong when their debit card was declined while paying for groceries on a normal weekday evening. Assuming it was a technical issue, they tried again at the ATM, only to see an error code indicating that transactions were not permitted. When they opened their mobile banking app, the balance was visible, but any attempt to transfer money or pay a bill triggered a vague system error.

There had been no suspicious transactions and no overdrawn balance. Salary had been deposited on schedule. Nothing looked unusual in the account history. The client had lived in Korea for several years and had never experienced anything like this before. The first emotional reaction was a mix of embarrassment at the checkout line, followed by growing anxiety: “Is something wrong with my visa? Did I violate some law without knowing? Am I in trouble with the bank?”

Why Banks in Korea Freeze Accounts Without Warning

To understand this korean bank account frozen case study properly, it is important to recognize why banks in Korea, and in many other countries, sometimes lock accounts without prior notice. In most situations, the trigger is not personal and not emotional. It is the result of automated flags, regulatory compliance requirements, or internal risk models that react to certain patterns of activity.

Common reasons include:

- Transactions that resemble money laundering patterns or high-risk transfers.

- Large or frequent international remittances without a clear documented purpose.

- Salary and declared employment status not matching the volume or type of transactions.

- Use of the account in ways not consistent with the customer’s original profile.

- Regulatory reviews connected to foreign nationals, where additional documentation is required.

The problem for foreigners is that they rarely receive detailed explanations in English. System messages are generic, staff may be cautious in what they say on the phone, and the official reason is often summarized as “compliance review” or “risk management.” Without local experience and language support, this feels like being locked out of your own life for unknown reasons.

Case Background: Who the Client Was and Why the Freeze Was So Risky

The client in this korean bank account frozen case study was a mid-career professional working for a multinational company in Seoul. They had a valid work visa, a stable salary, and a good relationship with their employer. Their bank account was used for:

- Monthly salary deposits from a Korean corporation.

- Automatic rent payments through scheduled transfers.

- Utility bills such as gas, electricity, and mobile phone.

- Occasional international remittances to family overseas.

Because all essential expenses were linked to this one account, any blockage was immediately dangerous. A frozen account meant the client would not be able to pay rent on time, settle credit card bills, or send money home. They also worried that the freeze might be reported somewhere that could later affect their visa or credit score.

First Reaction: Contacting the Bank Without a Clear Answer

As in many similar cases, the client’s first action was to call the bank’s customer service line. The frontline staff could see that the account had been limited but could not provide specific details beyond general phrases such as “internal review” and “risk-related reason.” When the client asked if this was related to fraud, a visa problem, or a mistake, the answers remained vague.

At the branch, the client was told to wait while staff members checked with a different department. After a long delay, they received a printed notice stating that the account was under review and that additional documentation might be required. None of this explained what had actually triggered the freeze. The client left the branch more confused than when they arrived.

By this point, the situation had gone beyond a simple banking inconvenience. Rent was due in a few days, and a scheduled international transfer to family had already failed once. The client realized they needed structured help to avoid worse outcomes.

How We Approached the Case: Rebuilding the Full Picture

When the client contacted us, they had already spent days trying to get clarity from the bank. Our first step was to map the situation chronologically and identify which elements might have triggered the freeze. We requested:

- Recent bank statements covering several months.

- Employer contract and latest salary certificate.

- Any messages or notices received from the bank.

- Details of recent international transfers or unusual transactions.

In this korean bank account frozen case study, one factor stood out: the client had recently increased the size and frequency of international transfers, sending money to family members abroad using descriptions that were very short and incomplete. From a compliance perspective, these patterns could be interpreted as unverified remittance activity, especially when combined with certain keywords or transaction routes.

Identifying the Likely Trigger: Transaction Patterns and Documentation Gaps

We compared the client’s employment and salary data with their bank activity. The total amounts were not suspicious by themselves, but some details were missing:

- International transfers lacked clear descriptions of purpose.

- There was no documentation in Korean explaining the relationship to overseas recipients.

- Some transfers seemed large in relation to the client’s recorded net income after rent and living expenses.

These points did not prove any wrongdoing, but they were enough for a risk-based system to flag the account. Once flagged, human reviewers inside the bank needed stronger documentation before allowing the account to function normally again.

Building a Documentation Package the Bank Could Not Ignore

To move beyond vague explanations and stalled discussions, we assembled a structured documentation package for the bank’s compliance team. The goal was to make it easy for them to see that the client’s activity was legitimate, consistent with their status, and properly documented.

The package included:

- An explanatory cover letter summarizing the client’s situation and reasons for each type of transfer.

- Employer contracts, salary certificates, and recent payslips, clearly showing income.

- Proof of relationship with overseas recipients where relevant.

- A breakdown of monthly living expenses in Korea to show disposable income.

- Copies of the client’s passport and residence card.

The cover letter, written in clear and respectful language, did not challenge the bank’s authority. Instead, it focused on transparency and clarity, acknowledging the bank’s duty to comply with regulations while providing complete context for the client’s financial behavior.

Submitting the Case to the Right Department

One of the common frustrations in cases like this is that clients keep talking to the wrong people. Frontline customer service staff are rarely empowered to make decisions about frozen accounts. In this korean bank account frozen case study, it was essential to ensure that the documentation reached the internal department actually responsible for the review.

We coordinated with branch staff and requested confirmation that the documents were forwarded to the compliance or risk management team. We also requested a formal acknowledgment that the package had been received and was under active review. This simple step helped create a clear record and timeline of the bank’s actions.

Throughout this process, the client remained calm but firm, avoiding emotional confrontations that could be misinterpreted. Maintaining a professional tone made it easier for bank staff to cooperate.

The Waiting Period: Managing Practical Risks While the Account Was Locked

Even with a strong documentation package submitted, the review was not instant. During this waiting period, we focused on protecting the client from immediate harm. Alternatives were arranged to cover urgent expenses:

- Temporary use of a secondary account for incoming salary if necessary.

- Advance planning with the landlord to avoid late-payment misunderstandings.

- Rescheduling non-essential remittances until the situation stabilized.

We also advised the client on how to document any financial difficulties caused by the freeze, just in case further negotiation or explanation was needed later. Showing that the client was acting in good faith and trying to meet obligations despite the restriction helped preserve credibility.

Resolution: How the Account Was Finally Released

After the documentation reached the appropriate team and was reviewed, the bank notified the client that the restrictions on the account would be lifted. The bank did not provide a detailed narrative explanation, but they confirmed that the case was closed and that the account could be used normally again.

Internally, it was likely that the documentation successfully demonstrated that the remittances were legitimate, linked to family support, and proportionate to the client’s income. The key was not to guess the exact reason, but to provide such complete context that any reasonable reviewer would be satisfied.

Lessons Learned From This Korean Bank Account Frozen Case Study

Several important lessons emerged from this experience, not just for the client in this korean bank account frozen case study, but for many foreigners living and working in Korea:

- Accounts are often frozen because of patterns, not because of personal accusations.

- Banks need clear documentation that connects income, lifestyle, and transfers.

- Generic phone explanations are not the end of the story; structured escalation matters.

- Proactive communication, backed by evidence, is far more effective than emotional complaints.

- Having a local support structure can dramatically reduce stress and risk.

For foreigners in Korea, a bank freeze can feel like a personal attack. In reality, it is often a sign that the system needs more information. Providing that information in a way that respects both compliance rules and the client’s situation is the real skill.

If you are also trying to improve your financial profile in Korea, you may find it useful to read our guide on building a Korean credit score as a foreigner. Understanding how banks see your profile can reduce the chances of unpleasant surprises later.

Practical Tips to Reduce the Risk of a Frozen Account

Although no one can guarantee that a bank account will never be frozen, foreigners can take practical steps to reduce the risk and improve their position if a freeze does occur:

- Keep salary, transfers, and expenses consistent with your declared profile.

- Use clear descriptions for international remittances, especially when sending to family.

- Maintain organized records of employment, income, and major payments.

- Respond quickly and calmly if the bank requests additional documentation.

- Seek assistance if communication barriers make it hard to understand the bank’s requests.

These actions will not only help in the event of a review, but may also support future applications for credit cards, loans, or housing contracts, where financial stability is closely evaluated.

When You Need Help With a Frozen Account

Foreigners in Korea often discover the rules of the banking system only when something goes wrong. By that time, important payments may already be failing, and every delay feels critical. Having a clear roadmap, proper documentation, and support with communication can make the difference between a prolonged crisis and a manageable incident.

This article is for informational purposes only and does not constitute legal or financial advice. For case-specific guidance, consultation with qualified professionals is strongly recommended.

JS Network: Solving Korea’s ‘Expat Nightmares’

Colin (Founder) | U.S. MBA | 11+ Yrs Global Experience

My Expertise:

• Expat ‘Nightmare’ Solutions (Visa, Housing, Banking)

• Global Trade & K-Product Sourcing (B2B/B2C)

• Premium Concierge & Travel Support

Contact Now:

📧 [email protected]

📱 Chat on WhatsApp | Chat on KakaoTalk

We respond quickly to all inquiries, but for 24/7 “URGENT” assistance (like a lost ARC or visa issue), please use Kakao/WhatsApp.

(All services are provided in conjunction with appropriate affiliated professionals (lawyers, administrative agents, judicial scriveners, etc.))

© JS Network Co., Ltd. | Expat ‘Nightmare’ Solutions 🌏 www.jsnetwork.co.kr